One of the most important lessons in investing is understanding the difference between “time in the market” and “timing the market.” The data consistently shows that long-term, consistent investing typically outperforms attempts to buy at lows and sell at highs.

The Cost of Missing the Best Days

The following chart demonstrates what happens to a $10,000 investment in the S&P 500 over a 20-year period (2000-2020) if you miss just a few of the best-performing days:

The results are striking:

- Stayed Fully Invested: A $10,000 investment grew to $42,231 (322% return)

- Missed 10 Best Days: Only grew to $19,347 (93% return)

- Missed 20 Best Days: Only grew to $11,908 (19% return)

- Missed 30 Best Days: Only grew to $7,365 (-26% return)

- Missed 40 Best Days: Lost money, ending with -$293 (-103% return)

Market Timing vs. Regular Investing

Let’s compare three hypothetical investors over a 30-year period:

The Three Investors:

- Consistent Investor: Invests $200 every month regardless of market conditions

- Market Timer (Good): Attempts to time the market with moderate success

- Market Timer (Poor): Frequently makes timing mistakes, missing opportunities

Even the “good” market timer underperforms the consistent investor in the long run.

Annual Returns vs. Staying Invested

This chart illustrates annual S&P 500 returns compared to what happens when you try to time the market and potentially miss positive years:

Notice how some of the best performing years (2003, 2009, 2019) often come immediately after negative years. Market timers who exit during downturns frequently miss these crucial recovery periods.

Why Time in Market Wins

The data consistently shows that time in the market beats timing the market for several reasons:

- Market timing is nearly impossible: Even professional investors cannot consistently predict market tops and bottoms

- Best days are concentrated: Many of the market’s best days occur shortly after its worst days

- Compounding requires consistency: The power of compounding works best with uninterrupted investment

- Emotional decisions hurt returns: Trying to time the market often leads to emotional buying and selling

- Transaction costs add up: Frequent buying and selling increases costs and taxes

Key Takeaways

- Stay invested: The longer you remain in the market, the better your chances of positive returns

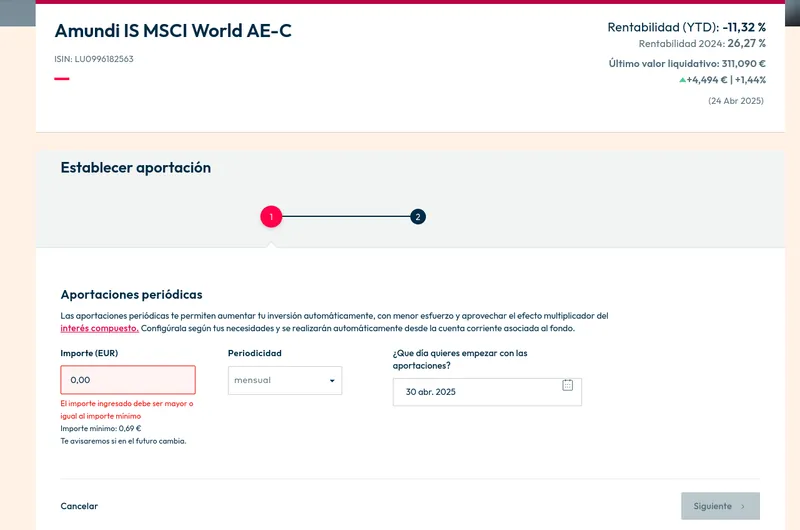

- Consistent contributions: Regular investments through all market conditions (dollar-cost averaging) typically outperform market timing

- Diversification matters: A well-diversified portfolio helps manage risk while staying invested

- Focus on time horizon: The longer your investment timeframe, the less important short-term market movements become

Remember: It’s not about timing the market, but time in the market that builds wealth.

Its about buying and waiting, not waiting and buying

An interesting option is to have automated buy to forget about it and automate that DCA